Nestled along the breathtaking Caribbean coastline of Mexico’s Yucatan Peninsula, Tulum has transformed from a tranquil beach town to a bustling tourist destination and a highly desirable real estate market.

Boasting beautiful beaches, ancient Mayan ruins, and an eco-chic atmosphere, Tulum has captured the attention of investors looking to capitalize on the thriving tourism industry and the rapidly appreciating property values in the Tulum real estate market. If you’re considering investing in Tulum real estate, now is the time to explore this captivating destination.

As with any real estate investment, understanding the market dynamics and potential return on investment (ROI) is essential before diving into Tulum’s property scene. Investors need to consider various factors, such as the current market trends, property types, and the best neighborhoods for investment, to make informed decisions and maximize their returns.

Last year we helped 124 investors from the USA, Canada and other parts of the world invest over $25 million USD in Tulum Mexico real estate market. And in this comprehensive guide, we will explore the opportunities and challenges of investing in Tulum’s real estate market.

And we will discuss the reasons to invest in Tulum, the potential risks and challenges, the best neighborhoods and property types for investment, strategies for maximizing ROI, tips for buying pre-sale properties, closing costs and other considerations, and resources and support available for investors.

By the end of this guide, you will have a deeper understanding of Tulum’s real estate market and how to get started.

3 Big Reasons to Invest in Tulum Real Estate

Here are the 3 big reasons to invest in Tulum Mexico real estate market as an investor.

1. Rapid Growth and Popularity of Tulum as a Tourist Destination

In recent years, Tulum has seen a surge in popularity, becoming a favored destination for travelers seeking a beautiful and serene escape. According to the Tourism Promotion Council of Quintana Roo, the number of international visitors to Tulum increased by 35% between 2017 and 2019. The area’s stunning beaches, world-class dining, and unique cultural experiences have caught the attention of tourists worldwide. As Tulum’s popularity continues to grow, investors have an opportunity to capitalize on the increasing demand for accommodations and services in the region.

2. Strong Demand for Vacation Rentals

Tulum’s vacation rental market has experienced significant growth as more travelers opt for private accommodations over traditional hotel stays. According to data from AirDNA, Tulum’s Airbnb listings increased by 40% between 2019 and 2021, signaling a strong demand for vacation rentals. This surge in interest presents a lucrative opportunity for real estate investors looking to generate consistent rental income and benefit from long-term appreciation.

For example, a well-managed vacation rental property in Tulum can generate 4-5% ROI during its first year, with potential returns increasing to 6-7% and even up to 9% in subsequent years, based on proper rental management and marketing strategies.

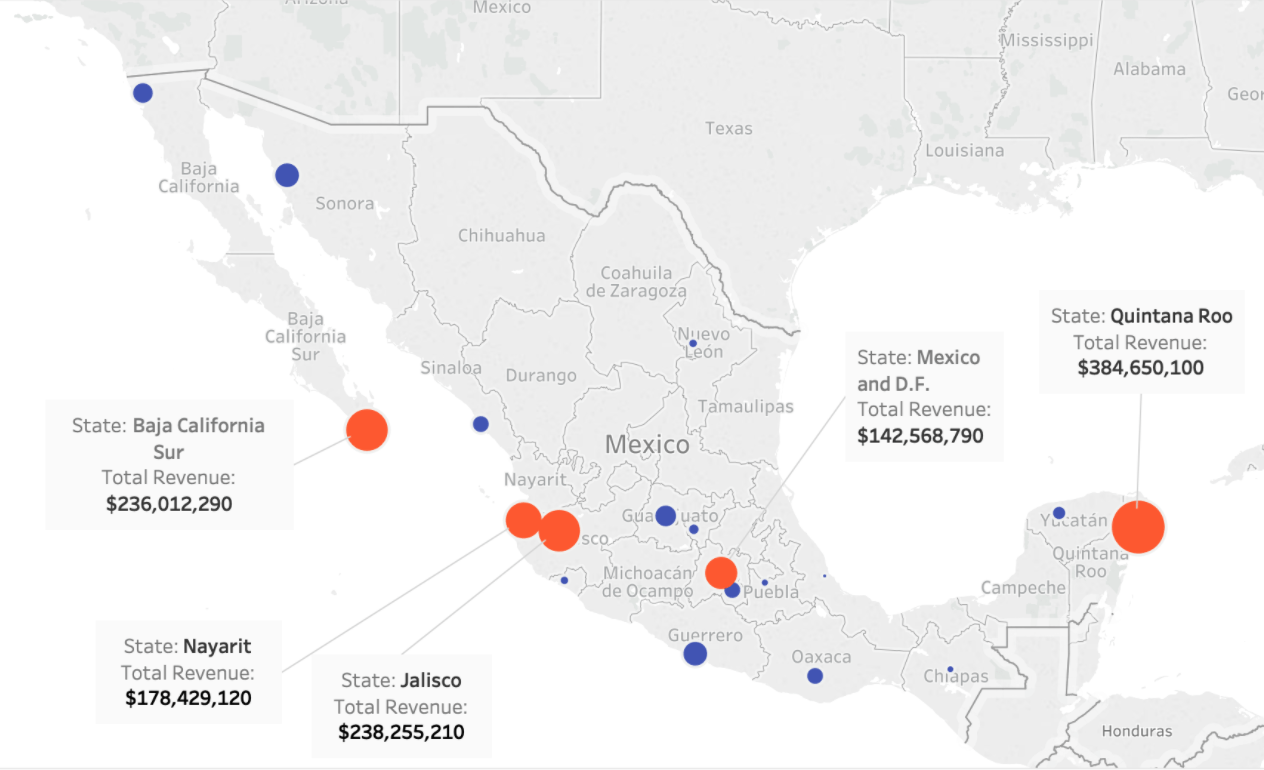

Quintana Roo the state of Tulum is the highest-grossing vacation rental market in all of Mexico.

3. Increasing Property Values Due to High Demand and Upscale Developments

As Tulum’s reputation as a premier vacation destination continues to grow, property values in the area are rising accordingly. The increasing demand for high-quality accommodations has spurred the development of upscale residential and commercial projects, driving up the value of properties in prime locations. For instance, Tulum has seen a remarkable increase in property prices, with condos and homes designed for international buyers ranging from $1,900 to $3,100 USD per square meter in pre-sales developments.

For investors looking to get in on the ground floor of Tulum’s rapidly expanding real estate market, now is the time to invest in this thriving community and enjoy the potential for substantial returns on investment.

Challenges and Risks of Investing in Tulum Real Estate

1. Difficulty in Flipping Properties Quickly for Profit

While Tulum’s real estate market presents numerous investment opportunities, it is essential to be aware that flipping properties quickly for profit might not be as straightforward as in other markets. For example, in 2020, the average time on the market for Tulum properties was 6 to 9 months, compared to a more established market like Miami, where the average time on the market was around 3 to 6 months. Investors should be prepared to hold onto their properties for a more extended period to realize their full potential value.

2. Unrealistic Expectations of Rental Income and ROI

It is crucial for investors to maintain realistic expectations when it comes to rental income and ROI in Tulum’s real estate market. While it’s true that some investors can achieve annual returns of up to 10-15%, these success stories often involve careful planning and exceptional property management. Investors should be mindful of factors such as seasonality, property management costs (typically 20-30% of rental income), and marketing efforts, all of which can impact rental income and ROI.

3. Competition from New Developments and Pre-Construction Properties

As the Tulum real estate market continues to grow, new developments and pre-construction properties have become increasingly popular. In 2021 alone, over 50 new residential projects were launched in Tulum. These projects often attract investors with attractive pricing and the promise of high returns, which can create competition for those looking to invest in existing properties. To stand out in this competitive market, investors should focus on differentiating their properties through unique features, high-quality finishes, and exceptional management.

4. Market Saturation and Potential Overdevelopment

With the rapid growth of Tulum’s real estate market comes the risk of market saturation and overdevelopment. In the last five years, the number of available properties has increased by more than 200%, raising concerns about the balance between supply and demand. Investors should be vigilant and monitor the market closely, keeping an eye on development trends and shifting dynamics to ensure their investments remain profitable in the long term. Working with a reputable local agent who understands the market and can provide expert guidance will be invaluable in navigating these potential challenges.

Understanding Tulum’s Real Estate Market

1. Buyer’s Market vs. Seller’s Market

The real estate market in Tulum, like any other market, can be categorized as either a buyer’s or seller’s market depending on the balance between supply and demand. As of late 2021, Tulum’s real estate market is leaning more toward a buyer’s market due to the increased number of new properties available. However, prime locations and unique properties still command strong demand and can sell quickly, making it essential for buyers to act fast.

2. Average Rental Rates for Different Property Types and Seasons

Rental rates in Tulum can vary significantly depending on property type, location, and season. For example, during the high season (December to April), a one-bedroom condo in a prime location may rent for an average of $150-200 per night, while a similar property during the low season (May to November) may rent for $100-150 per night. A luxury villa, on the other hand, can command rental rates of $500-1,500 per night during high season and $300-1,000 during low season. These rates can be affected by factors such as proximity to the beach, amenities, and the overall quality of the property.

| Property Type | High Season (Dec-Apr) | Low Season (May-Nov) |

|---|---|---|

| One-Bedroom Condo | $150-200 per night | $100-150 per night |

| Luxury Villa | $500-1,500 per night | $300-1,000 per night |

3. Vacation Rental ROI Potential and Factors Affecting Returns

Investors in Tulum’s vacation rental market can potentially achieve ROIs of 10-15% or more; however, several factors can affect returns. These include:

- Seasonality: Rental demand and rates fluctuate throughout the year, with high season commanding higher prices but also higher competition.

- Property management and upkeep: Effective property management is crucial to maintaining high occupancy rates and guest satisfaction, but it comes with costs (typically 20-30% of rental income).

- Marketing: Successful rental properties require effective marketing strategies to attract guests, which can include listing on popular platforms like Airbnb and VRBO and investing in professional photography and SEO.

4. Impact of Economic Factors on the Market

The Tulum real estate market is not immune to economic factors that can impact demand and property values. For example, fluctuations in exchange rates between the Mexican Peso and the US Dollar can affect both the local economy and foreign investment. To minimize risks and make well-informed decisions, investors should stay informed.

If you work with our real estate agents they will keep you up to date and help you navigate the Tulum real estate market so you invest in a great property.

Best Neighborhoods and Property Types for Investment

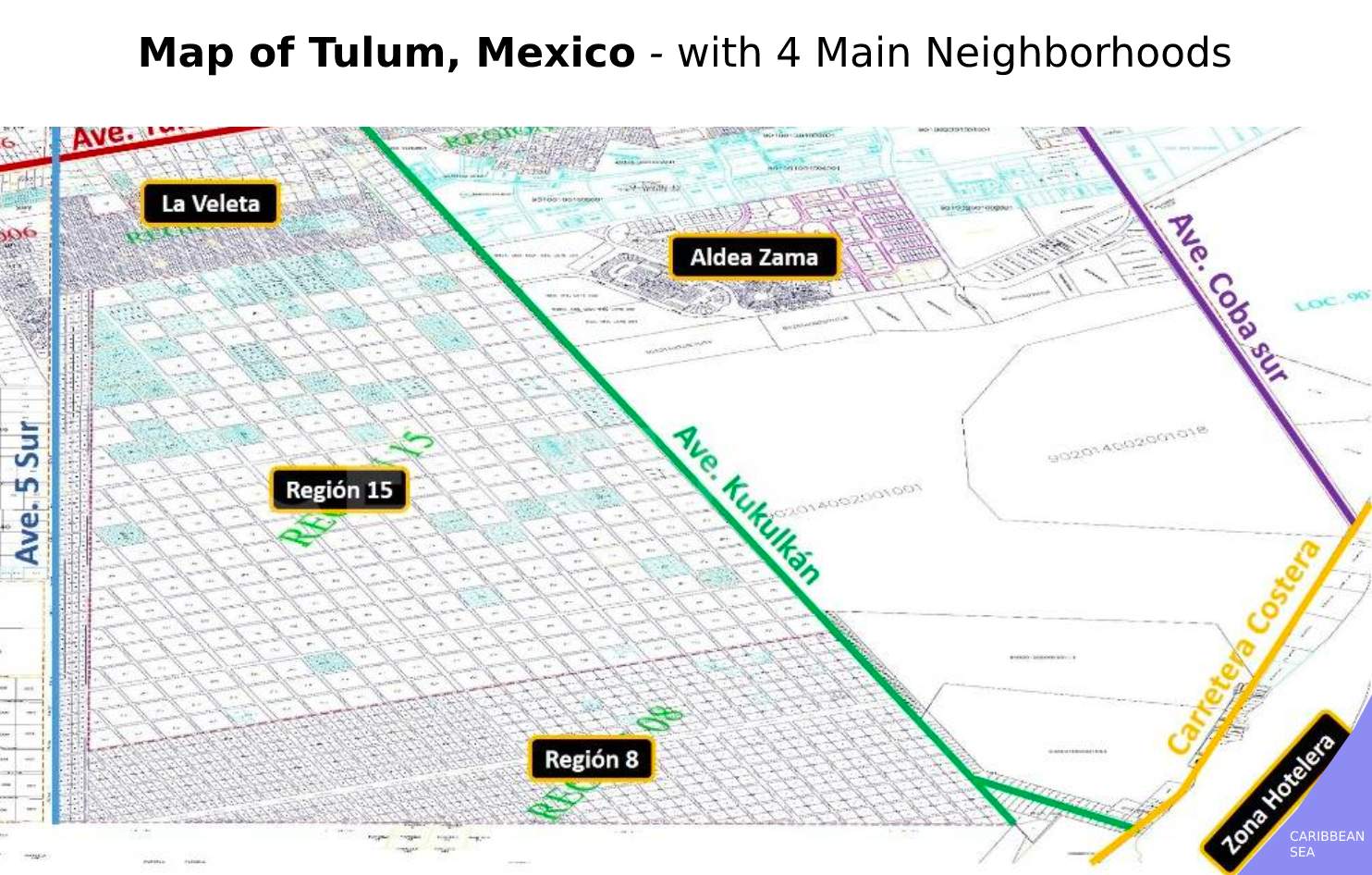

Tulum is divided into 4 main neighborhoods, Aldea Zama, La Veleta, Region 15, and Region 8. Below is a map outline with the zona hotelera zone and sea to the bottom right.

Each of these 4 main neighborhoods and regions offers something completely different for vacationers and vacation home buyers.

Best neighborhoods (regions) for investment in Tulum Mexico

Aldea Zama: Luxury Condos, Single-Family Homes, and Amenities

Aldea Zama is a master-planned community located between Tulum’s town center and its pristine beaches. Known for its upscale condos, single-family homes, and modern amenities, this neighborhood attracts high-end vacationers and expats alike. Properties in Aldea Zama typically range from $200,000 to $800,000, and rental rates can vary from $150 to $450 per night, depending on the property’s size, location, and season.

Region 15 & La Veleta: Developing Area with Potential for Future Growth

La Veleta & Region 15 is an up-and-coming area in Tulum, featuring a mix of modern condos, boutique hotels, and single-family homes. With prices generally lower than in Aldea Zama, La Veleta and region 15 offers investors more affordable entry points and the potential for future growth as the area continues to develop. Properties in this neighborhood can range from $100,000 to $500,000, with nightly rental rates between $75 and $300, depending on the property and season.

Region 8: One of the Newest Regions in Tulum and Closest to the Beach with Great Potential for Appreciation and Rental Income

Region 8 is one of the newest developments in Tulum and boasts close proximity to both the beach and the town center. This area is primed for growth, offering investors excellent opportunities for appreciation and rental income. Properties in Region 8 range from $150,000 to $600,000, with nightly rental rates averaging between $100 and $350, depending on the property type, location, and season.

Click here to explore the 7 best areas to invest in Tulum Mexico.

Condo Hotels: High ROI Potential Through Hands-Off Investment

Condo hotels are a popular investment option in Tulum, providing investors with a hands-off approach to property management while still reaping the benefits of high occupancy rates and rental income. These properties typically come with professional on-site management, allowing investors to capitalize on Tulum’s thriving tourism industry without the hassle of managing their own vacation rental. Condo hotels in Tulum can range from $200,000 to $1,000,000, with potential ROI of 10-15% or more, depending on factors like location, management fees, and occupancy rates.

Read more about Condo Hotels as an investment in Mexico.

Beachfront Properties: Limited Availability and Higher Prices

Beachfront properties in Tulum are a scarce commodity due to strict building regulations and limited land availability. Consequently, these properties command premium prices and can offer strong returns for investors who can afford the higher entry cost. Beachfront properties in Tulum can range from $800,000 to over $3,000,000, with nightly rental rates of $500 to $2,500 or more, depending on the property’s size, location, and amenities.

Click here to read more about Tulum beachfront properties.

Strategies for Maximizing ROI on Tulum Properties

Professional Rental Management and Marketing

Hiring a professional rental management company can help maximize your Tulum property’s ROI by ensuring consistent occupancy rates, competitive pricing, and efficient property maintenance. A good property management company will leverage their local knowledge and expertise in marketing your property on popular rental platforms like Airbnb and VRBO, utilizing high-quality photos, accurate descriptions, and strategic pricing. Investors who work with professional rental management companies can typically expect to see an increase in their rental income by 20-30%, depending on the property and market conditions.

Providing Exceptional Customer Service to Attract Repeat Renters

Exceptional customer service is essential for attracting repeat renters and garnering positive reviews, which in turn helps boost occupancy rates and rental income. Going above and beyond to provide guests with a memorable experience can lead to higher occupancy rates, allowing investors to command higher nightly rates and achieve better ROI. Some ways to provide exceptional customer service include offering personalized recommendations for local attractions and restaurants, providing a welcome gift or basket, and being responsive to guest inquiries and concerns.

Target Specific Market Segments, Such as Eco-Conscious Travelers or Wellness Enthusiasts

Tulum has become a hub for eco-conscious travelers and wellness enthusiasts, drawn to the area’s natural beauty, yoga retreats, and eco-friendly accommodations. By targeting these specific market segments, investors can differentiate their properties from the competition and command premium rental rates. For example, investing in a property with eco-friendly features like solar power, rainwater collection systems, or sustainable construction materials can help attract environmentally-conscious renters. Similarly, offering wellness-focused amenities such as yoga and meditation spaces, on-site spa services, or healthy meal options can entice wellness enthusiasts and lead to higher occupancy rates and rental income.